Environmental, Social, and Governance (“ESG”) are three non-financial pillars that measure corporate activities. ESG goes beyond financial metrics and measures an organization’s long-term impact on the planet, community, and stakeholders. Investment managers face increased demand for ESG-driven portfolios in the face of a new era of investing, investors, and FinTech. A key consideration for investment managers is how the implementation of technologies, such as open architectures, and data and analytics can create more clarity around ESG investing and metrics, as well as constructing scalable and customizable portfolios, specific to ESG, for investors.

Against the backdrop of modernized investment management products and services, investment managers are competing in a post-COVID era and a new “world order”. As such, a convergence of forces is driving ESG growth across the globe:

- Evolving public sentiment around ESG-related issues

- Buy side perception of ESG (including a shift in mindset across US organizations), regulation, and investor pressure for ESG-centric policies and products

- Individualization of ESG pillars

- Market consolidation across the data provider landscape

- Standardization of data

- Growth of private markets

- Shift from active to passive investing

- Enabling technology to create personalized portfolios

ESG has been around for several decades and has recently gained significant momentum across the world. While firms’ responses to the demand for ESG investing and sustainable practices have varied over time, the call from investors and regulators for meaningful ESG practices is now too loud to suppress. Investment managers are at a cross-roads of developing meaningful ESG propositions, however, data management is the Achilles’ heel towards real ESG implementation and adoption. Celent sees ESG investing as a cornerstone of NextGen investors’ portfolios, so firms who succeed in ESG implementation will be well-positioned to attract these investors. Another important consideration of ESG within a portfolio is investor desire for customization, largely driven by the client experience and expectation in adjacent industries, as well as advancements in technology enabling this possibility. Portfolio customization is an approach to investing where an individual’s preferences, like risk tolerance, ESG interests, family planning, or tax optimizations are at the core of the portfolio (rather than a plug-play type of portfolio designed for all). One approach to portfolio customization is through direct indexing, which is underpinned by fractional trading.

A major hurdle that the industry faces specific to ESG is “Greenwashing”. Greenwashing is when a company makes misleading claims or puts forth a false image about their ESG products, processes, or policies to give the impression that they are more ESG-friendly or ESG-centric than they really are. Greenwashing is prevalent due to the lack of standardization of foundational definitions, regulations, and an adherence to global frameworks. The data which is used to assess a company’s ESG progress or intiatives is often self-reported, untimely, unaudited, and inconsistent. The implementation of sophistcated and mature technologies, such as cloud, artificial intelligence, machine learning, natural language processing, and even blockchain, can play a role in moving the industry away from greenwashing. For example, NLP can sift through and contextualize billions of structured and unstructured data points, while blockchain has the potential to help connect data sources into one central repository and ultimately create a benchmark against which ESG metrics can be measured. There is also potential for the tokenization of index funds (specific to ESG, or not), that can be traded on a decentralized exchange. Of course, regulation will determine where and how the industry evolves.

Mature ESG integration solutions offer a bespoke framework designed to sanitize and reconcile data ratings from major ESG data providers by leveraging today’s transformative technology, such as cognitive technologies and AI/ML. These models create a 360-degree view of the ESG performance of assets and investments. Investment managers are using more advanced technologies, credit to modern architectures, which enables them to capture more and newer structured and unstructured data points, and importantly, run large data models.

The first step to making headway in ESG implementation is setting clear objectives of what is meant to be achieved, then secondly assessing internal resources and infrastructure for project execution. Investment managers who are deliberating the question of “building versus buying” data for the purpose of creating ESG portfolios will realize that the answer varies by the size and resourcing capacities and constraints of their institution.

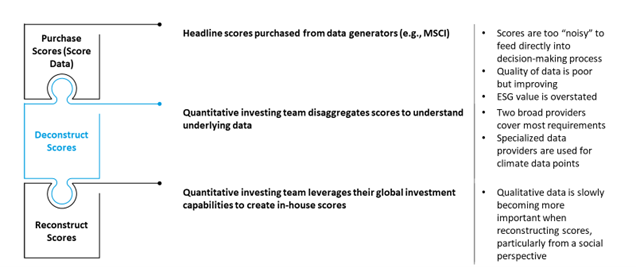

Large investment managers have the resourcing, capacity, and budget to access raw data and customize it as necessary. Typically, large Tier 1 institutions purchase multiple third-party scores and combine data to create in-house scores. Through this data acquisition, deconstruction, and rebuilding, investment managers are better equipped to meet their portfolio preferences. Third-party ESG ratings/sub-scores are used to create custom indices, for example. There is significant demand for data to be directly integrated and/or imported into an investment manager’s internal software platform, such as Sustainalytics and SS&C Advent Genesis platform. This feature is also highly coveted by smaller investment managers who often require pre-packaged, pre-integrated solutions that can contextualize data points and include features like sentiment analysis.

Large Buyside Firm Example

Source: Celent, SS&C Advent, Oliver Wyman

ESG investing has gained momentum in the wake up the pandemic and as regulators and investors increase pressure on firms to operate in a sustainable way and offer ESG-centric products. The method in which investment managers consume and make sense of ESG data for the purpose of constructing ESG-driven portfolios, including customized portfolios, hangs in the balance as the industry awaits data transparency and standardization at a regulatory level.